Recycling the Petrodollars

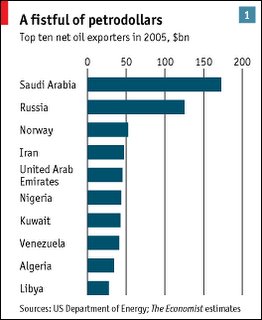

This year, oil exporters could haul in $700 billion from selling oil to foreigners. This includes not only the Organisation of Petroleum Exporting Countries (OPEC) but also Russia and Norway, the world's second- and third-biggest earners (see chart 1 below). The International Monetary Fund estimates that oil exporters' current-account surplus could reach $400 billion, more than four times as much as in 2002.I had thought that the Chinese were the ones mainly impacting the US trade deficit and buying up our Treasury bonds to keep interest rates low. But this article implies that the oil exporting countries have a lot to do with it (and possibly more).

Despite the lack of hard data, many economists are sure that a big dollop of petrodollars is going into American Treasury securities. If so, the recycling of money via bond markets could have very different effects on the world economy from the bank-mediated recycling of previous oil booms. If petrodollars not spent flow into global bond markets, they reduce bond yields and thus support consumer spending in oil-importing countries.

Around two-thirds of petrodollars are thought to have gone into dollar assets, pushing down American bond yields. Although higher oil prices have increased America's current-account deficit, Mr Jen reckons that it probably runs a balance-of-payments surplus in oil, with capital inflows from exporting countries exceeding its net oil import bill.

I still don't understand how the US can run up such big deficits and still have interest rates stay so low. This article helps to explain that. In a way, the higher gas prices are acting as a tax. Instead of a tax which would decrease the deficit directly and lower interest rates, the increased oil prices give money to the oil producing countries which they then invest in treasury bonds keeping interest rates low. In the short term, there isn't much difference to the US economy. But in the long term, those oil producing countries are going to want their money back and then the US is going to be in a world of hurt.

This is a really fascinating article. I would recommend reading it all if you are interested on the impact of the higher oil prices on the world economy.

Via Economist.com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.